North Carolina law prohibits the possession, sale, and trafficking of controlled substances. Yet the same State that prosecutes those  offenses also taxes and therefore profits them. Is that right? Does that make sense? Should the government profit from crime? Is it OK to tax Drugs? Extortion? What about Illegal Pornography, Prostitution and Human Trafficking? Where do we, the governed, draw the line?

offenses also taxes and therefore profits them. Is that right? Does that make sense? Should the government profit from crime? Is it OK to tax Drugs? Extortion? What about Illegal Pornography, Prostitution and Human Trafficking? Where do we, the governed, draw the line?

The Controlled Substance Tax, codified at N.C.G.S. § 105-113.105, operates on the premise that illegal drugs have taxable value even though their sale and possession are criminal acts. The idea that “income is income” regardless of source smacks of Machiavelli and a willingness to bend basic moral imperatives. Beneath that procedural logic lies a troubling contradiction, if not outright hypocrisy.

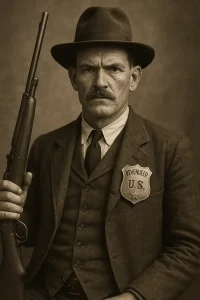

Questions about punishment, profit, and fairness aren’t theoretical when you are the one standing before the court. North Carolina law distinguishes between fines, forfeiture, and taxation, but for clients facing criminal charges, those differences often feel academic. Bill Powers and the Powers Law Firm handle serious criminal matters in Mecklenburg, Union, Iredell, Gaston, Rowan, and Lincoln Counties, examining how the law operates in real courtrooms, not just in theory. Bill Powers is a widely regarded North Carolina criminal defense attorney, educator, and legal commentator with more than thirty-three years of courtroom and trial experience. He is recognized throughout the state for his work on impaired driving, criminal law, and legal education, and is a recipient of the North Carolina State Bar Distinguished Service Award. For select legal matters, Bill Powers consults on a statewide basis. To discuss your case in confidence, TEXT or call 704-342-4357.

Carolina Criminal Defense & DUI Lawyer Updates

Carolina Criminal Defense & DUI Lawyer Updates question in constitutional law. When government agents enter private property without a warrant, what happens to the evidence they obtain?

question in constitutional law. When government agents enter private property without a warrant, what happens to the evidence they obtain?